Private Equity & Investment Managers

The complete GRC solution for private equity and investment managers

Streamline and centralize compliance processes and strengthen risk management across your investment portfolio.

.png?width=673&height=673&name=Group%20193%20(1).png)

Industry challenges

In today's regulatory environment, portfolio managers must oversee and manage risks across their portfolio companies to maintain compliance and protect asset value. What's more, managing and having oversight on the compliance maturity of their investments is challenging given the siloed nature of their operations, but critical given that cybersecurity and regulatory compliance are imperative in ensuring the longevity of their investments.

Our solution

Streamline and centralize risk management and compliance processes across your investment portfolio with 6clicks. Provide your portfolio companies with their own GRC tool, making it simple for them to improve their overall GRC maturity and share the insights you need to help mature their risk and compliance programs. Define and enforce common standards across your portfolio and roll-up reporting to provide key stakeholders insights into your portfolio's overall maturity.

Better manage risk and compliance

Auditing across multiple teams

Risk and issue libraries for standard remediation

Static audit report and document generation

Managing multiple GRC programs across an investment portfolio

Pain

Sending and responding to audits across teams using email and spreadsheets

Using email and spreadsheets for audit processes presents challenges such as version control issues, limited collaboration, data security concerns, the lack of audit trail, potential data entry errors, resource intensiveness, and overall inefficiency.

Solution

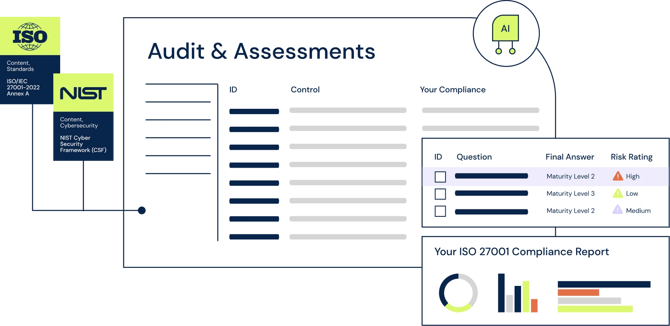

6clicks streamlines the audit processes across your teams, from planning to remediation. It offers a simple approach to sending and responding to assessments and audits, robust audit trails, benchmarking, status management, collaboration, and comprehensive reporting. The audit and assessment module is also tightly integrated with our risk and issues modules to streamline remediation, significantly reducing inefficiencies and pain points associated with spreadsheets, emails and highly repetitive manual processes.

Explore related features

Pain

When everyone describes the same issue in different ways

When everyone describes the same remediation risk or issue in different ways, it creates a significant challenge in achieving consistent reporting. This inconsistency leads to confusion, miscommunication, and a lack of clarity regarding the nature and severity of the issue. It hinders the organization's ability to aggregate and analyze data effectively, making it challenging to prioritize and address remediation efforts efficiently. As a result, it can lead to delays in resolving critical issues, increased compliance risks, and difficulties in demonstrating compliance to stakeholders and regulatory bodies.

Solution

Utilizing 6clicks' issue and risk libraries resolves the issue of inconsistent descriptions of remediation risks or issues across teams. This solution standardizes terminology, promotes clarity, and streamlines data aggregation. It enables more efficient remediation efforts, reducing delays and compliance risks while simplifying compliance reporting to stakeholders and regulatory bodies. In addition, it fosters knowledge sharing for ongoing improvement.

Explore related features

Pain

Cut and pasting from spreadsheets to documents to create static reports

Manually copying data from various spreadsheets and word documents when running an audit or assessment to produce static reports is extremely time-consuming, error prone and inefficient.

Solution

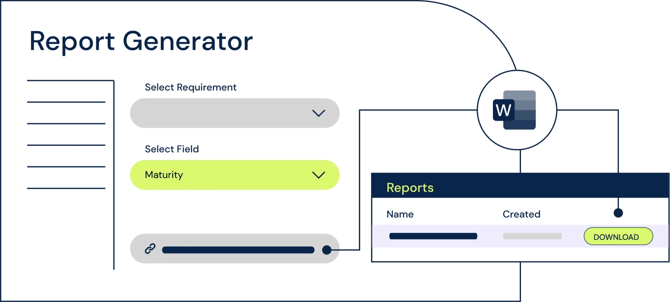

By utilizing 6clicks' report generator, you can automate the creation of audit and assessment reports, saving significant time and reducing manual effort. Define audit report templates, everything from layout to style, integrate data sources and automate data retrieval, streamlining the entire audit report creation process and ensuring best practice and repeatability every time.

Explore related features

Pain

Managing and reporting on multiple GRC programs cases across investment portfolios

Solution

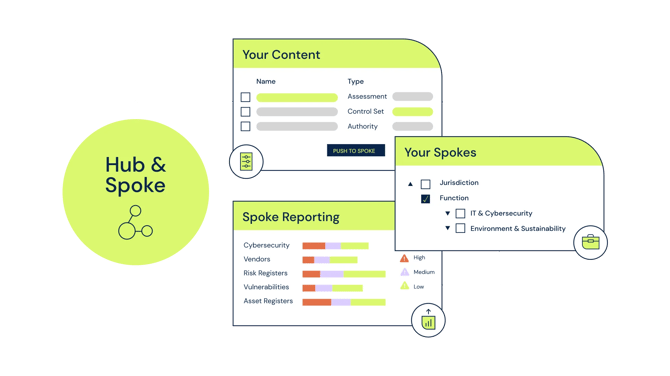

6clicks' unique Hub & Spoke architecture provides a centralized risk and compliance function that spans distributed GRC programs and use cases across a portfolio. The Hub makes it possible to define risk and compliance best practices and content centrally, which is 'pushed down' to Spokes that utilize the full suite of 6clicks GRC modules for day-to-day activities or simply to run internal audits and maturity assessments. Consolidated reporting and analytics are rolled up at the Hub level, giving investment managers comprehensive reporting and insights across their portfolio.

So why choose 6clicks?

Traditional GRC

6clicks

Deployment

Monolithic software

Everyone battles and creates a mess in the same system

Multi-tenanted

We pioneered connected, multi-team GRC; it’s called Hub & Spoke

Artificial intelligence

Superficial at best

Jumping on the bandwagon

First AI engine built for GRC

We started building in 2019 and continue to innovate

Content

No

Priced separately or BYO

All included

100’s of standards, laws and regulations, risk libraries, audit templates and more

Implementation & support

Time and rate billing

Pay per hour or day

Included and predictable

From implementation to support for your success, we’re there every step of the way

Advisor enabled

After thought

Like fitting a square peg into a round hole

The perfect fit

Embed your own IP, apply branding and scale with your clients

Pricing

Highly complex

Pay per module, user, vendor, etc.

Simple: unlimited everything

Just pay per spoke

Intelligently accelerate your cyber risk and compliance program today

Pricing

We are the only GRC platform on the market truly designed for private equity and investment managers, thanks to our unique Hub & Spoke architecture. Set your firm up as the Hub, then create Spokes for your respective portfolio companies. Define your best practice audit and assessment templates and embed them into 6clicks or use ours, run unlimited free assessments with your portfolio companies and generate insightful aggregate reports, all from the Hub. Your portfolio companies can then upgrade to a Growth license and access all our modules, powerful AI engine and Content Library for a single yearly fee, with unlimited users and content. Additional billing either being charged to you, or the portfolio company, depending on what works best.